Auction will help meet mobile broadband demand and support 5G mobile

UK regulator, Ofcom, has announced how valuable airwaves will be released to meet the growing demand for mobile broadband, including new measures to safeguard competition.

People and businesses increasingly need reliable, high speed mobile broadband to support devices such as smartphones and tablets.

Ofcom is helping to meet this demand by releasing extra spectrum, allowing mobile operators to increase their networks’ capacity.

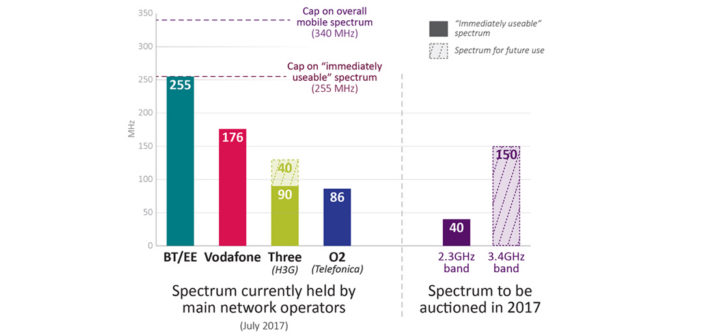

Later this year the regulator will auction licences to use 190 MHz of spectrum in two frequency bands, increasing the airwaves available for mobile devices by almost one third.

Altogether, 40 MHz of spectrum will be auctioned in the 2.3GHz band. This band is already supported by mobile devices from manufacturers such as Apple and Samsung. These airwaves could be used immediately after release to provide extra capacity, meaning faster downloads and internet browsing for mobile users.

In addition, 150 MHz of spectrum will be auctioned in the 3.4GHz band. These airwaves are compatible with most current mobile devices, but are expected to be usable by future phones and tablets. The 3.4GHz band has been identified as central to the rollout of 5G mobile across Europe.

The auction rules are designed to reflect recent market developments and safeguard competition over the coming years. When auctioning the spectrum, Ofcom will impose two different restrictions on bidders. These will limit the amount of spectrum operators can win in the 2.3GHz band; and place overall limits on the spectrum an operator can win across the 2.3GHz and 3.4GHz bands in aggregate.

First, as proposed in November last year, Ofcom will place a cap of 255 MHz on the “immediately useable” spectrum that any one operator can hold as a result of the auction. This cap means BT/EE will not be able to bid for spectrum in the 2.3GHz band.

Secondly, Ofcom has decided to place a new, additional cap of 340 MHz on the overall amount of mobile spectrum a single operator can hold as a result of the auction. This cap amounts to 37% of all the mobile spectrum expected to be useable in 2020, which includes not only the spectrum available in this auction but also the 700MHz band.

Taken together, the effect of the caps will be to reduce BT/EE’s overall share of mobile spectrum; the company can win a maximum 85 MHz of new spectrum in the 3.4GHz band.

The overall cap also means that Vodafone could gain a maximum 160 MHz of spectrum across both the 2.3GHz and 3.4GHz bands.

Based on today’s spectrum holdings, there will be no restriction on the amount of spectrum that any other bidder could win.

As Ofcom has previously said in its Strategic Review of Digital Communications, it will also look to include new obligations in future spectrum licences to ensure rural coverage continues to improve, and are making further spectrum available for mobile in the 700MHz band in 2020. This band is well suited for improving rural coverage and reaching deep inside buildings. It is currently used by Freeview TV and wireless microphones, and Ofcom will seek to place new coverage obligations on companies who win these licences at the next award.

Ofcom’s final auction rules reflect several important developments in the market since it consulted last November. For example: Changes in the availability of additional 5G spectrum. Ofcom had expected that an additional frequency band for future mobile services, including 5G – the 3.6GHz to 3.8GHz band – was likely to be available at around the same time as the 3.4GHz band becomes useable for mobile. It now has less confidence that it will be useable nationwide by that time. Therefore, releasing the 3.6 to 3.8GHz band cannot be relied upon to tackle competition concerns that arise from 2020. The new overall spectrum cap addresses these concerns.

Ofcom still intends to make the 3.6 to 3.8GHz band available for mobile as soon as possible, and will shortly publish its proposed approach.

Ofcom stated: “It may be harder for networks to keep up with demand without more spectrum. Evidence shows operators with lower shares of spectrum cannot easily deliver more capacity by relying on other approaches, such as more masts. This means any large imbalances in spectrum ownership may present stronger concerns. This strengthens the case for both caps in the auction.

“We have also taken account of market developments that help the competitive position of some existing operators. Three now has more spectrum. After acquiring UK Broadband in February, the operator Three has access to 40 MHz of mobile spectrum in the 3.4GHz band, plus 84 MHz in the 3.6 to 3.8GHz band.

Three and Vodafone have extra spectrum available in the near-term. Each holds 20 MHz of spectrum in the 1400MHz band, acquired in a trade from Qualcomm in 2015. This spectrum is now becoming useable for mobile and is being rolled out in Europe. These airwaves could be used by Three to improve its capacity in the near term, around 2018, before it can put its other spectrum to work.”

Philip Marnick, Ofcom’s spectrum group director, said: “Spectrum is a vital resource that fuels the UK’s economy. We’ve designed this auction to ensure that people and businesses continue to benefit from strong competition for mobile services.

“We want to see this spectrum in use as soon as possible. With smartphones and tablets using even more data, people need a choice of fast and reliable mobile networks. These new airwaves will support better services for mobile users, and allow operators to innovate and build for the future,” concluded Marnick.