Revenue for first quarter down but operating profit up quarter on quarter

Samsung Electronics has announced poor financial results for the first quarter ended 31 March 2015, despite being back on top of the smartphone shipments tree after defeating Apple in the first quarter, according to Strategy Analytics.

Samsung’s revenue for the quarter was KRW 47.12 trillion, an 11% decrease quarter on quarter, while the operating profit for the quarter was KRW 5.98 trillion, an increase of KRW 690 billion quarter on quarter.

In the company’s earnings guidance disclosed on 7 April 7 2015, Samsung estimated first quarter consolidated revenues would reach approximately KRW 47 trillion with consolidated operating profit of approximately KRW 5.9 trillion.

The first quarter saw growth across the Device Solutions (DS) and IT and Mobile Communications (IM) divisions. The Memory Business further accelerated its 20-nanometer class migration for DRAM, while DDR4/LPDDR4 sales increased for mobile devices and servers. The Display Panel segment saw profit growth, as OLED panels for smartphones and LCD panels for premium TVs saw increased sales. The Mobile Business also saw profit growth, due to increased sales of new middle to low end smartphones, all the while decreasing marketing expenditures.

Smartphone sales increased quarter on quarter for Samsung, taking it globally back into the lead, beating Apple that took the title in the fourth quarter 2014. However, tablet and feature phone sales decreased, along with a decreased average selling price, resulting in a slight decrease in revenue.

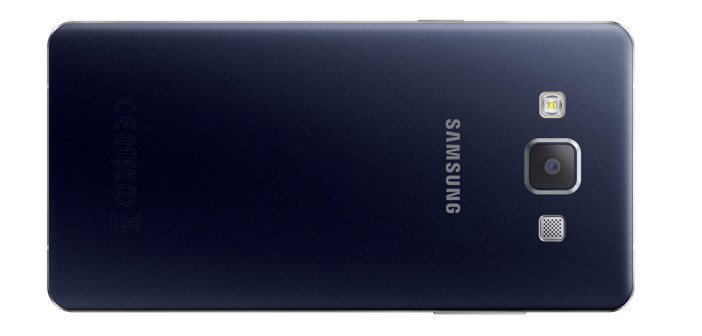

Meanwhile, earnings improved due to more efficient management of marketing expenditures for the mobile division, expanded sales of middle end smartphones including the Galaxy A Series, and a strengthened premium line up following the introduction of the Galaxy S6 and S6 edge.

Looking ahead, Samsung said its flagship smartphone sales are expected to pick up with sales of the Galaxy S6 and S6 edge, launched at Mobile World Congress. Also, as the specification of smartphones in general become increasingly sophisticated, demand for mobile chips are expected to grow, the company added.

In the second quarter, market demand for smartphones and tablets is expected to remain at a similar level quarter on quarter. Global sales are expected to improve with the global launch of the Galaxy S6 and S6 edge. In particular, the Galaxy S6 and S6 edge have been receiving positive feedback from the market, stated Samsung.

However, total smartphone shipments are expected to remain at the same level as the previous quarter, due to a possible decrease in sales of middle to low end models, while marketing expenses are expected to increase due to the global launch of the Galaxy S6 and S6 edge.

In 2015, continued growth for Samsung is expected due to the growth of emerging smartphone markets, such as China and India, as well as the global expansion of the LTE business. However, increased competition in the middle to low end market and a possible decrease in demand due to the impact of foreign exchange rates in specific regions may present challenges, the company added.

The IM Division will drive smartphone sales growth in 2015 by strengthening its leadership in premium smartphones and actively responding to the growing middle to low end market with a streamlined line up, said Samsung. Further, the overall cost efficiency across all business areas, including R&D and marketing, will be increased to improve profitability.

In the second quarter, the company expects its overall earnings to increase compared to the previous quarter, despite an expected growth in marketing expenditures. With premium smartphone sales entering into full swing, the DS Division is expected to see demand in growth for its semiconductor products. The IM Division earnings are expected to grow, due to increased global sales of the Galaxy S6 and S6 edge.

The System LSI Business is expected to improve its overall business performance through increased supply of 14-nanometer application processors in the second quarter. The Display Panel segment expects smartphone and TV sales to boost its earnings from OLED and LCD panel sales. Meanwhile, the Consumer Electronics (CE) Division expects to see improvements, as seasonality should improve air conditioner sales, while the flagship SUHD TV sales are expected to increase.

However, Samsung warned that looking ahead to the rest of 2015, despite strong seasonality, competition is expected to toughen for the set business and there is also a risk of weaker demand due to the weak Euro and emerging market currencies. For the component business, while Samsung expects stable supply and demand conditions, weak demand for set products and increase in LCD panel supply may negatively affect earnings. While the information technology (IT) industry has typically had a weak first half and a strong second half each year, this may be less so for 2015.