By Laurent Dardé, marketing director for secure mobile transactions at NXP

It has been widely predicted that 2016 will be the year in which mobile payments truly take off. Although this has also been predicted in previous years but failed to materialise, this time it will be different. For the first time, demand and infrastructure are colliding to make mobile payments an easy, secure way to pay that consumers actually want to use.

Cashless overtakes cash

Earlier in 2015, it was announced that the number of transactions using cashless payment had overtaken that of cash payments in the UK for the first time ever. This came from an announcement that the use of cash by consumers, businesses and financial organisations fell to 48% of payments in 2014 by Payments UK.

The trade association also claimed that this trend will continue, with the number of consumer payments using cash expected to be just 34% by 2024.

As part of this trend, contactless payments have grown enormously over the past few years, and in 2014, more than one billion tap-and-go purchases were processed in Europe alone, according to Visa. Contactless payments have evolved even further into mobile payments, which allow consumers to ditch their plastic cards by making payments with their smartphone.

It is widely forecast that 2016 is the year in which mobile payments will finally become mainstream, as many elements of the robust ecosystem needed for mass adoption are now actually in place. Contactless cards have been widely adopted, which are key to the success of ‘tap-and-pay’. Almost every point of sale terminal newer than three years has contactless functionality already built-in and payment network operators Mastercard and Visa are pushing NFC acceptance for all payment terminals.

In addition, mobile payment has a growing target market of vendors in the form of pop-up stores, smaller retailers and local events, which are growing in popularity. The speed, security and convenience of mobile payment makes it a particularly popular choice for these types of small vendors.

Tipping point

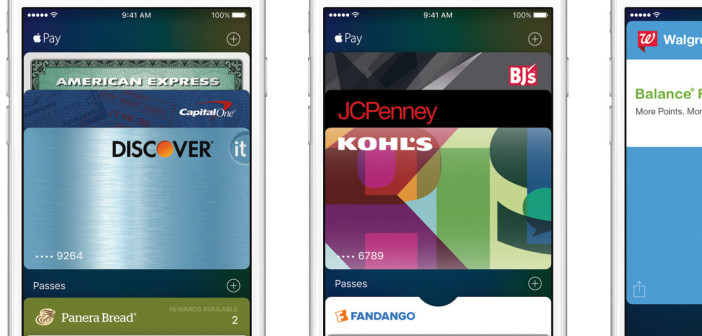

The advent of ApplePay, Android Pay and Samsung Pay could finally be the tipping point that the industry needs for mobile payment to become truly mainstream. Apple in particular has a loyal army of fans willing to adopt any of its technologies, indicating that the pick-up of Apple Pay will steadily rise.

This has been recognised by retailers and banks, a large number of which signed up to support Apple Pay’s launch. With the launch of Samsung Pay and Android Pay, consumer interest is at its peak. For example, research by Visa found that nearly half (47%) of UK shoppers are interested in using mobile payment to make everyday purchases.

This progression is extremely positive but it can’t be ignored that traction of mobile payments has been somewhat stunted until now. Research in June this year showed that only one in five iPhone 6 users had made a purchase with Apple Pay immediately following its launch.

Mobile payments had previously faced a classic chicken or egg scenario. For the technology to go mainstream, there needed to be mass adoption from either consumers or retailers. But consumers wouldn’t adopt technology that they couldn’t use, and retailers wouldn’t invest in technology that consumers haven’t adopted.

Mass commercialisation

However, as the necessary infrastructure is now available and popular technology companies such as Android, Samsung and Apple have released mobile payment solutions, it is likely that the long-awaited mass commercialisation of mobile payments will finally arrive in 2016.

To ensure that this widescale adoption happens, all players in the ecosystem must ensure that their infrastructure works seamlessly and has been safeguarded against any security concerns. In this way, they will be able to meet consumers’ growing demand for contactless payment solutions and drive a multitude of industries into the future.

NXP is a provider of secure chip technology in banking cards, a co-inventor of NFC and a technology partner behind some of this year’s new mobile payments solutions.