Bank offers login to mobile app using just a fingerprint following feedback from customers

From today RBS and NatWest customers with an iPhone 5S, 6 or 6 Plus will be able to log into to mobile banking with their finger print. From 19 February, RBS and NatWest customers will be the first of any UK-based bank to be able to login to their mobile banking app using only their finger print.

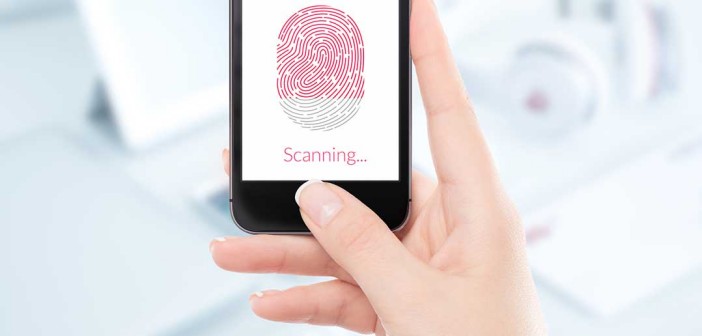

Using Apple’s new Touch ID fingerprint sensor, RBS and NatWest customers who have an iPhone 5S, iPhone 6 and iPhone 6 plus will be able to access their mobile banking app within seconds. The technology recognises the customer’s unique finger print, meaning they do not have to remember a tricky passcode, making it easier and more convenient to access their finances.

Phil Underwood, global head of pre-sales at mobile security provider of Tokenless two-factor authentication, SecurEnvoy, commented on the announcement: “This announcement from RBS and NatWest on their adoption of fingerprint technology is a landmark moment for two factor authentication (2FA) entering the mainstream.

“There is always a balancing act when it comes to authentication,” continued Underwood. “Make it too easy for the user and the authentication may be compromised or circumvented; too hard and adoption rates for the new authentication technology will drop. This shows that there is now a middle ground that is secure enough for banks to remain regulatory compliant, but easy enough to lead to widespread adoption.”

RBS and NatWest have introduced Touch ID following feedback from their customers, who took to the banks’ online community forum ‘Ideas Bank’ to ask for the latest technology in the mobile banking app.

More and more of RBS and NatWest’s customers are using digital technology to bank. Nearly 50% of the banks’ 15 million customers actively use online banking, with over three million customers using the mobile app every week. RBS and NatWest have 1.8 million active iPhone users who use the app on average 40 times per month.

RBS and NatWest’s busiest branch is the mobile app itself; over 167,000 of RBS and NatWest’s customers use it between 7am and 8am on their commute to work every day.

Stuart Haire, managing director, RBS and NatWest Direct Bank, said: “There has been a revolution in banking, as more and more of our customers are using digital technology to bank with us. Adding Touch ID to our mobile banking app makes it even easier and more convenient for customers to manage their finances on the move and directly responds to their requests. Our aim is to be the number one bank for customer trust, service and advocacy so we want to continue adapting our service based on the valuable feedback we receive from our customers every day.”

Underwood added: “One of the main drivers of this authentication technology taking hold, is that the current generation’s device of choice is now firmly the smartphone, with there now being over 1.75 billion devices in use worldwide and this is ever growing. Today, 2FA is all around us and prevalent on popular web sites such as PayPal, Gmail and Ticketmaster. With the advent of reliable fingerprint readers on the latest smartphones, the second ‘something the user knows’ component is switched from a potentially easy-to-break password to a physical one that is unique. So the technology is at everyone’s finger tips, literally,” he concluded.